Simplify Your Oversize/Overweight Loads

- Instantly Determine Permit & Escort Costs

- Calculate Max Legal/Permitted Axle Weights

- Understand Equipment Limits

Fuel Permits - IFTA Permit - Temporary IFTA Permits

Do you remember “bingo” plates. After World War II, as the country was returning to a peace-time economy, North American interstate and international trucking began to grow. And soon, the states and provinces of North America began to take notice. Big trucks were buying fuel and causing wear and tear on the state and national highways. States started levying fuel taxes on trucking,

Trucking is largely interstate, and states soon noticed that truckers were buying fuel in one state with lower prices and lower taxes and driving right through other states that had higher fuel costs. Laws were passed that required truck operators to obtain a fuel tax sticker for each state. The sticker was about the size of a large postage stamp that was displayed on a license-plate sized plaque with indentations for each tax sticker—the “bingo” plate. Operators were required to record mileage driven in each state, and periodically file a tax return and pay a fuel tax equivalent to the fuel they used while driving through each state.

The International Fuel Tax Agreement (IFTA) was adopted in 1986 to replace these cumbersome and inconsistent interstate and international truck permitting and fuel tax collection processes that had existed since 1945. With IFTA, an operating carrier obtains an IFTA license and two decals for each qualifying vehicle it operates. The carrier files a quarterly fuel tax report. This report is used to determine the net tax, or a refund, due and to redistribute taxes from the collecting states to states in which taxes were due.

The goal of IFTA was to simplify the payment of taxes by truck operators and to equitably disburse taxes among jurisdictions. With IFTA, each jurisdiction, i.e., state, province, or other special jurisdiction (e.g., Washington, D.C., etc.), would be responsible for its own licensing and tax collection. In return, each truck would require only one license, one set of decals, and file taxes with only one authority—the jurisdiction of the operator’s base of operations.

Simply, the truck operator buys fuel when and where needed, keeps the fuel receipts and a record of mileage driven in each jurisdiction, and files a single quarterly IFTA report with his home jurisdiction. This “home jurisdiction” then reviews the report and distributes the taxes collected to each jurisdiction based on the reported miles driven in each jurisdiction. Instead of having multiple fuel tax stickers for each jurisdiction, each truck has two fuel stickers, (one for each side of the cab of the truck), and a copy of the license that must be kept in the truck. Each truck operator must file a quarterly report that includes the miles driven in each state and records of all fuel purchases.

If a truck is operated only within, and never leaves, its home state, no IFTA license or stickers are required. However, if that truck makes even one trip outside of the state without an IFTA license (or a special permit), the operator is subject to fines, penalties, even possible impoundment of the load and/or the vehicle. Operators may obtain a one-time or limited permit to operate into another state. This requires prior planning and authorization. Operators my obtain a maximum of 10 special permits per calendar year. If more than 10 interstate trips are necessary, IFTA membership is required.

Like income tax, if more tax has been collected than required by the filing, the operator will receive a refund (or credit) for the overpayment. If the tax liability is greater than the tax paid, the operator is expected to pay the tax at the time of filing the quarterly report. Note once you have an IFTA sticker on your vehicle, you must file quarterly reports, even if you did not operate your vehicle out of your home state. There are penalties, including a $50.00 fine, for not filing the quarterly report. An operator must file a quarterly report for every truck registered with IFTA. If a truck is taken out of service, the operator must notify his home state IFTA to have the vehicle registration canceled, otherwise quarterly reports will be expected.

How it works

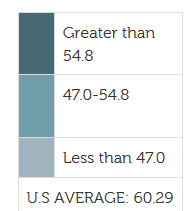

IFTA was created to simplify tax computations for truckers and collections for states/jurisdictions. One of the problems is that fuel taxes vary, sometimes significantly, from one state to another (Figure 1). With IFTA, when a motor vehicle buys fuel, any fuel taxes paid are credited to that licensee's account. At the end of the fiscal quarter, the licensee completes his fuel tax report, listing all miles traveled in all states/jurisdictions and lists all gallons purchased on the IFTA Quarterly Fuel Tax Return. The form includes a calculation for Average Miles per Gallon (AMG or MPG) that is applied to the miles traveled to determine the tax liability to each jurisdiction.

Figure 1. The map shows the differences in diesel fuel tax rates across the United States. IFTA collects and apportions taxes to each state (jurisdiction) based on miles driven by each truck in each state, each quarter. Before 1986, truckers and operators had to file individual fuel tax returns with each individual state in which the truck was operated.

Trip And Fuel Permits By State

IFTA simplifies or streamlines tax filing for truckers by requiring only one filing per quarter. If the sum of fuel taxes paid exceeds the amount of tax due, the operator may request a refund, or use it as a credit towards the next quarter’s taxes. If taxes are owed, the amount due must be included with the filing of the quarterly tax return. The single tax return is sent to the operator’s home or “member” state. The member’s IFTA jurisdiction is responsible for disbursing funds to other jurisdictions. Any audits will be conducted by the operator’s member’s state. Note that, “weight-mile” taxes, if required by a state, are included in, and collected as part of the quarterly filing.

Note that there are agencies that will assist in preparing the quarterly filing if the trucker can provide accurate miles-per-state driven and records of fuel purchases.

IFTA was created to be more convenient for drivers and a more efficient way of collecting and equitably distributing taxes to the states.

Frequently Asked Questions

1. What is an IFTA “jurisdiction”?

When first established IFTA jurisdictions included the “lower 48” states and 10 Canadian provinces. Alaska, Hawaii, Washington, D. C., and the northern territories of Canada are non-IFTA jurisdictions, however Alaska, Washington, D. C. and the Canadian territories participate in IFTA.

2. Who must register with IFTA?

IFTA registration and filings are required for motor vehicles operated across two or more jurisdictions in the United States and Canada and that are “used, designed, or maintained for transportation of persons or property and:

- The power unit has two axles and the weight exceeds 26,000 pounds gross vehicle or registered gross vehicle weight

- The Power Unit has three or more axles regardless of weight

- Is used in combination, when the weight exceeds 26,000 pounds gross vehicle or registered gross vehicle weight.”

If you operate a qualifying vehicle only within the boundaries of your home state and do not cross other jurisdictional boundaries, then you are not required to register with, or obtain an IFTA license or permit.

3. Do I need an IFTA permit if I only drive into another state once in a month?

Yes. An operator is limited to 10 special permits per year. If more than 10 trips per year are made from your home jurisdiction, an IFTA license and decals are required.

4. Who Must Apply for an IFTA Permit and Stickers

You must obtain an IFTA license if you operate a qualifying motor vehicle in two or more U.S. states and/or Canadian provinces that are members of the International Fuel Tax Agreement.

A recreational vehicle such as a motor home or a pickup with a camper is not considered a qualified motor vehicle when an individual uses it exclusively for personal pleasure. Vehicles used in connection with a business operation are not considered recreational.

5. What Records Are Required?

All registered carriers must maintain records of individual vehicle mileage trip reports that include mileage per state or province—to be summarized monthly—as well all receipts or electronic records showing all fuel bought at service stations.

6. What are the Filing and Reporting Requirements

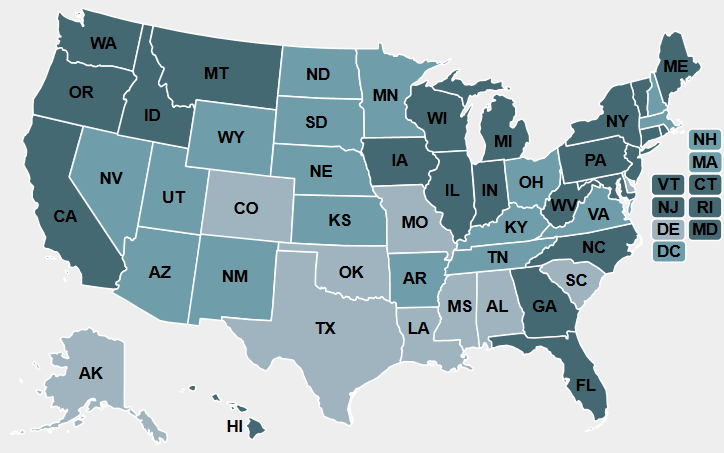

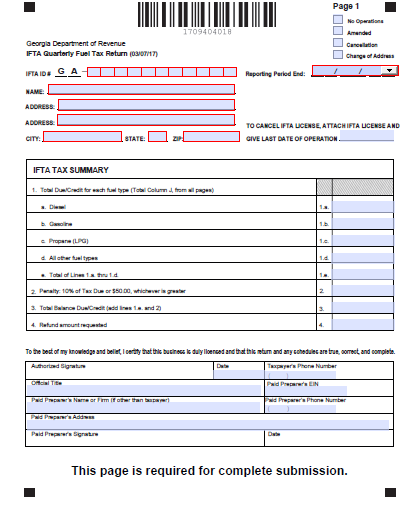

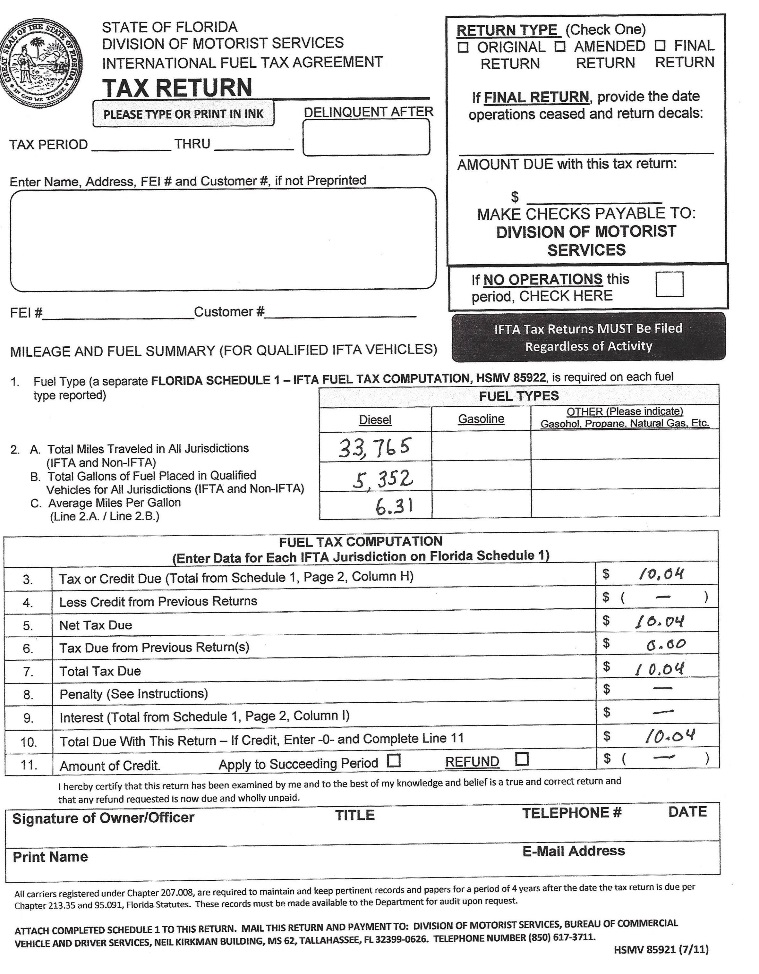

IFTA fuel tax returns must be filed quarterly, within 30 days after the end of March, June, September and December. Late filing will result in a $50 penalty plus a 1% penalty for each month the balance due is not paid. Figure 2 shows an example of a state IFTA tax return.

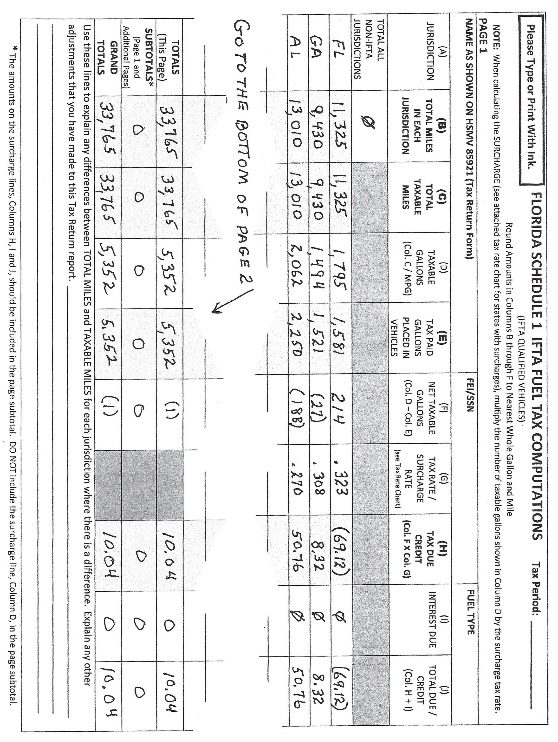

Figure 2. Pages 1 (left) and 2 of a typical quarterly IFTA Fuel Tax Return Schedule (State of Georgia). The layout of the pages may vary from state-to-state, but the information required is consistent. Page 1 includes all information required for the individual or operator of the truck, a record of fuel types used, a summary of the balance due or credit due, the amount of the refund requested, and the signature block for the filer. Some state forms include the computation for Average Miles per Gallon (AMG or MPG) on Page one. Page two includes the data required for each jurisdiction (state) in which the truck traveled including, miles in each state, fuel quantity purchased (gallons), and taxes paid (dollars and cents) and computations for taxes due or to be credited to the operator. Credits may be carried over to be used against the next quarter filing (Page 1, lines 3 and 4 in the example). There will be additional pages to allow spaces for all applicable states and provinces.

7. How do I file my IFTA report?

Most jurisdictions allow (encourage) online filing. Go to the IFTA website for the state in which your business is registered. There you will find complete instructions and blank online forms to complete. Complete the forms—some calculations will be required—and submit it with your payment method if taxes are due. The actual tax forms may vary by state, so follow the instructions provided on the site.

8. What if I don't have accurate miles per state?

Having an accurate record of miles driven per state, as well as fuel purchases is required for IFTA filings. Data can be maintained in trip log books or software programs. There are also several versions of truck management software available, which can ease the work and provide an accurate record. The key is to have a valid record of miles driven in each state, and all fuel purchases readily available to (1) complete quarterly fuel tax returns and (2) to have available in case of an audit.

9. I did not drive out of my home jurisdiction during the second quarter of the year. Do I still have to file the quarterly return?

The Answer is most emphatically “yes,” you must file a return. There will be no numbers to enter, and you will not owe anything, but if you have an IFTA license, you are required to file quarterly reports even if you did not leave your home state. There is an automatic $50 fine for failing to submit a report by the due date.

10. Is there a penalty for late payments?

Yes, and the penalty can be costly. First, there is an assessment of $50.00 or 10% of the net tax liability, whichever is greater, for late-filed reports or failure to file or for underpayment of the tax due. Even if your tax liability is zero, or you are due a refund, the $50.00 penalty will be assessed when returns are late. Additionally, an interest rate at 1 % per month will be assessed on all delinquent taxes due.

11. How does a late filing affect my IFTA license?

This varies by state. Failing to file too many times may result in revocation of your IFTA license. Also, if you are late on any filing and payment of taxes at the end of the year, you may not be permitted to renew your IFTA license.

12. What Documents are required to file quarterly tax return?

Each operator must have fuel receipts, either paper or electronic, as well as trip report records of accurate mileages driven in each state and/or province. Of course, the IFTA license and permit decal numbers must also be included.

A Quick Example

The following example uses the Florida IFTA Tax Return. As indicated earlier, each state is responsible for collecting taxes from operators based in that state. Consequently, each state has designed its own tax forms. Still, each state is required to collect specific information to satisfy IFTA requirements, and therefore state tax returns are similar. For example, all returns require the operator to compute Average Miles per Gallon (AMG or MPG). The first page of the form will also have a summary of all calculations showing total miles driven, total fuel purchased, and any taxes due or to be refunded.

Page 2 is usually a worksheet with columns for total miles by state, summary of fuel purchases and amount of fuel used in each state, with calculations of taxes due to each state based on that fuel use. Since fuel taxes may vary significantly from state to state, after all of the computations are completed, you may owe fuel taxes or you may have paid more than required and have a credit.

Figure 3. In this simple return, a Florida-based operator is reporting operations in Florida, Georgia, and Alabama. Each return has detailed instructions on what data is required and how to compute the required data. The accuracy of the data in the form is important, and therefore, it is important to maintain detailed records (receipts, etc.) of all fuel purchases as well as records of mileage driven in each state.

Most taxes due should be relatively low since you have already paid some tax at the time fuel is purchased. In the above example, fuel tax is owned only for the state of Florida ($69,12). Since there are positive credit balances for the other two states, the tax bill is only $10.04 for the quarter. Some state forms have lines identified for each state and province. In any case, states expect the entire form—even blank pages—to be submitted.

Summary

Any way you look at it, paying taxes is never fun. But completing the tax returns can be the greater challenge. The IFTA forms, however, are essentially straight-forward, require data that truckers usually record as part of their daily operations, and only require the time to do the calculations. Just double-check the math!

See Also

Axle weight regulations by state